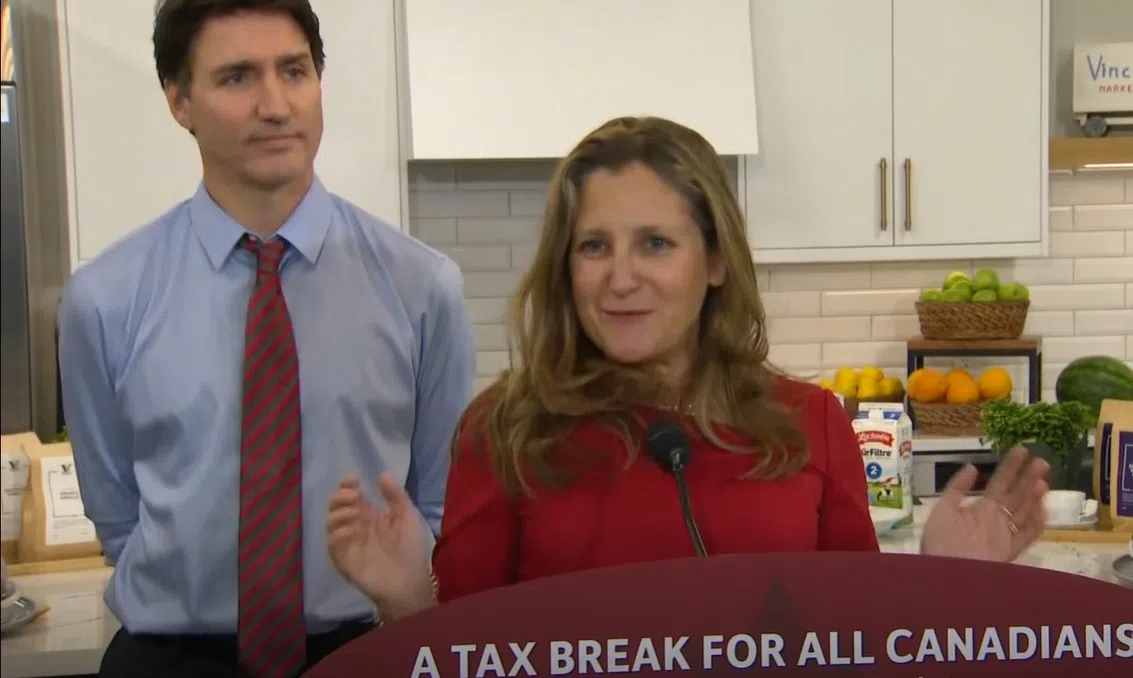

Thursday Finance Minister Chrystia Freeland and Prime Minister Justin Trudeau announced tax relief for Canadians. Trudeau says it starts December 14th and will last for two months. Finance Minister Chrystia Freeland says it looks like Canada is going to have a soft landing from the Covid recession allowing the federal government to remove GST on what she describes as a carefully chosen basket of holiday gifts. It will be applied to kid’s clothes and shoes, car seats, toys, books, restaurant meals, beer and wine and prepared meals at the grocery store like a rotisserie chicken are among the items which will be temporarily GST free.

The Canadian Federation of Independent Business (CFIB) welcomes any tax cutting measure, but adds that narrow, temporary sales tax holidays can add confusion and administrative complexity for small business owners. The CFIB says Canadians need permanent, not temporary tax relief and explains that a temporary tax relief will require retailers to reprogram point of sale systems twice in a two-month window. In a statement the CFIB suggests reducing the small business corporate tax rate or payroll taxes like Employment Insurance and CPP premiums are among the top priorities for small business owners.

And the Prime Minister announced today that if you worked in 2023 and earned up to $150,000, in what the federal government calls the working Canadians rebate, will mean you are going to receive a $250 cheque in April. The CFIB notes that six weeks after the sales tax holiday ends in mid-February, the federal government plans to hike the carbon tax by 19 per cent on April 1 while cutting the carbon rebate to small firms by nearly half.

The federal NDP is taking credit for the tax break with leader Jagmeet Singh wanting to permanently remove the GST from essentials including diapers, prepared meals, cellphone and internet bills and he was also urging provincial governments to match the plan with cuts to provincial sales taxes.

Premier Scott Moe wrote a letter to the federal NDP leader saying, “I note that you are asking provincial governments to remove the PST on home heating, which is a necessity in Canada, particular during the winter months. Saskatchewan’s Crown owned natural gas provider SaskEnergy does not charge the PST on residential natural gas. However, the Trudeau government, which you support, requires SaskEnergy to charge both the carbon tax and the GST on residential SaskEnergy bills.”

Parliament has been dead-locked and in order to get the measures passed through the House of Commons, the Liberals will need the support of an opposition party.

A GST/HST exemption will apply to:

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches.

- Restaurant meals, whether dine-in, takeout, or delivery.

- Snacks, including chips, candy, and granola bars.

- Beer, wine, cider, and pre-mixed alcoholic beverages below 7 per cent ABV.

- Children’s clothing and footwear, car seats, and diapers.

- Children’s toys, such as board games, dolls, and video game consoles.

- Books, print newspapers, and puzzles for all ages.

- Christmas trees.

This tax break is projected to last until February 15, 2025.